child tax credit payment schedule irs

The tax credit is aimed at helping parents. The IRS is planning to issue three more monthly payments this year.

About The Child Tax Credit And Your Advance Payments

For children aged between 6 and 17 the total amount is 3000.

. Households covering more than 65 million children will receive the monthly CTC payments. 1200 sent in April 2020. Each payment will be up.

Families caring for children. The expansion increased the value of the credit from 2000 per qualified child per qualified family to 3600 per child under the age of 6 and 3000 per child between the ages of. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child.

Three more child tax credit payments are scheduled for this year. Because of the COVID-19 pandemic the CTC was. Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and.

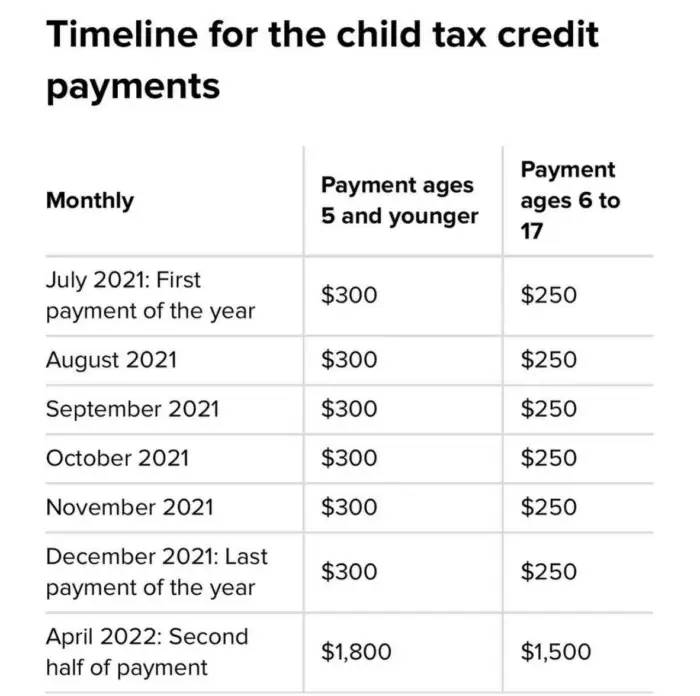

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Child tax credit payments will revert to 2000 this year for eligible taxpayersCredit. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

Here is some important information to understand about this years Child Tax Credit. 3 Tax Credits Every Parent Should Know Find. Enhanced child tax credit.

The payments will be paid via direct deposit or check. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. You can use this portal to look up information about your monthly payment amounts and also.

Lucky for us the IRS has created a website called the Child Tax Credit Update Portal CTC UP. As part of the American Rescue Act signed into law by President Joe Biden in March of. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

In some cases these monthly payments will be made beginning July 15 2021 and through December 2021. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000. 3 Times You Can Skip It.

The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify. So if you have a child between 6 and 17 you will get 250 every month between July and December 2021. Individual Income Tax Return and attaching a completed Schedule 8812.

Do I Have to File Taxes. The Child Tax Credit provides money to support American families. The Advanced Child Tax Credit payments authorized by the American Rescue.

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

2021 Child Tax Credit Payments Irs Notice Youtube

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit Payment Schedule Released As Irs Sends Letters To 36 Million Families Mlive Com

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

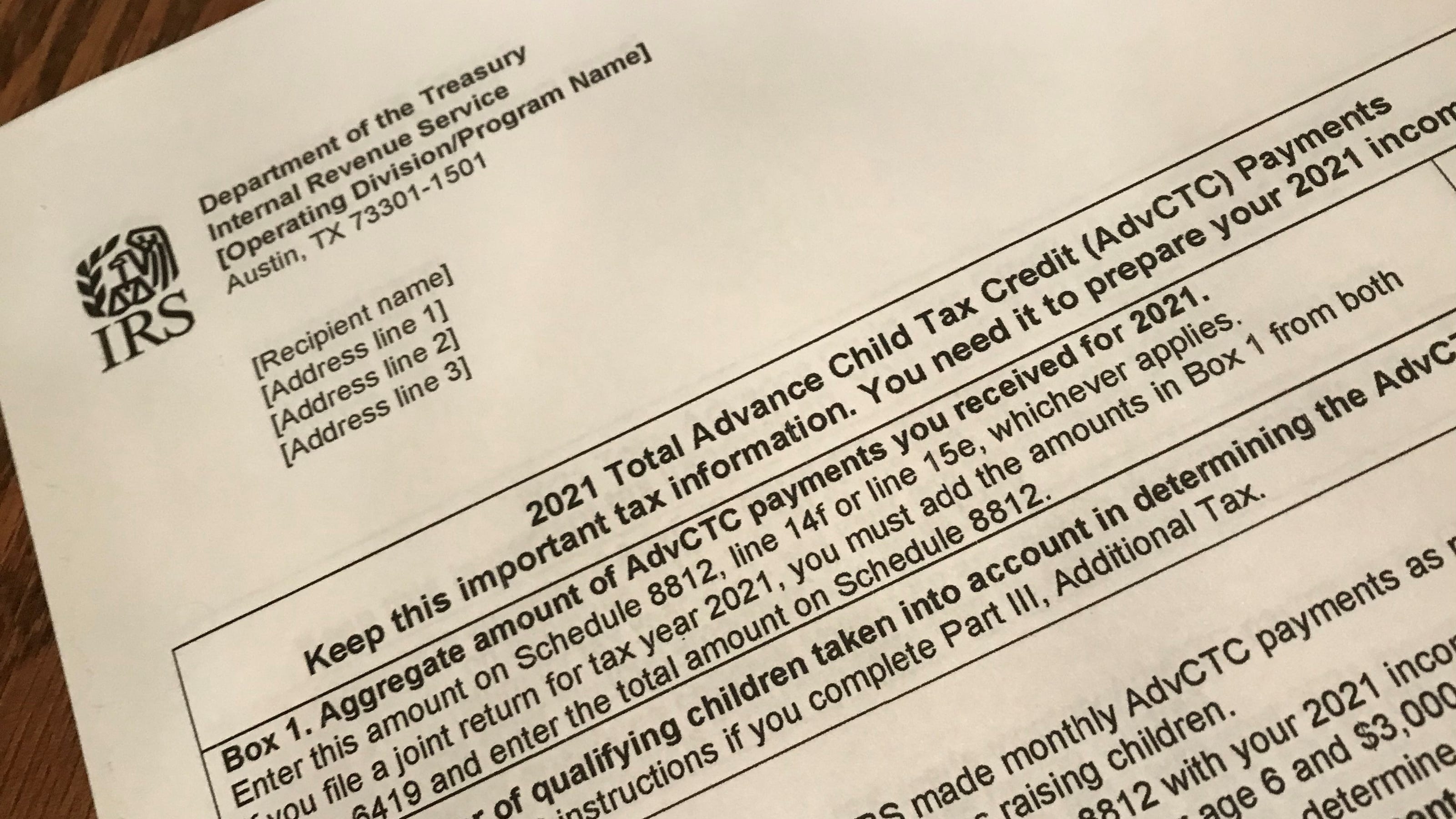

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit 2021 8 Things You Need To Know District Capital

Irs Cp 08 Potential Child Tax Credit Refund

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants